About us

A non-profit making organization which was established in 2014 by a team of development activists. We have a proven record of impact of village savings and loans. Our thematic areas include village savings and loans (VSLA), Agriculture, Education and Health.

Village Savings and Loans Associations (VSLA)

WHAT foundation started with one man, one brain, lone effort to 21-staff, 3- females, 18-males

WHAT Foundation works started in 2014 with 5 groups of gari processers and farmers in Mandari and Ga, these groups have been trained to moblise savings and take loans. This has boosted their gari processing massively and gained them some machinery support from the Rural Enterprises Project, Bole. Now 550+

From no partner/collaborator to 6 partners and collaborators:

- GIZ/MOAP-NW

- Bole community co-operative credit Union

- Tietaa Cooperative Credit Union

- Wa Workers Cooperative Credit union

- BUSAC FUND

- DAs, MA in Wa Municipal, Wa West, Wa East, STK, Bole

From no office to 2 offices, head office in Wa and a sub office at Sawla STK

From mother organization to mother and subscidiary financial NGO. We established a financial NGO (Sungibaala Finacial NGO) in 2019 to provide for savings, small and smart credits, and susu services to unbanked in rural communities we work.

Establishment of work based Co-operative Credit union (Sungbaala)- Wa and Bulenga, providing financial inclusive services to farmers and groups/ VSLAs and FBOS

Tijaamalibu Enterprise

Sungbaala Cooperative Credit Union

A TO Z TRUST LTD

From cash system to Momo digitization system.

From 1 district to 9 districts

From 1 group in 2014 to 550 groups in 2025

From impacting 25 individuals lives in 2014 to 15000 individuals in 2025

From one community to about 315 communities

From one region Savannah to UWR and UER

From one crop (Cassava) to 9 crops (cassava, groundnuts, maize, soya, rice, sorghum, cashew, mango, fruits and vegetables).

From OD learners to OD certified Consultant.

KAIZEN Practioners

From a worldwide restricted VSLA member savings methodology to an innovative flexible savings methodology (allowing persons to save more).

Set to introduce Digital or Remote VSLA

Sustainable Agriculture

Agriculture lies at the core of rural livelihoods, and we are committed to encouraging the use of sustainable farming practices and technologies enhance food security and income generation for smallholder farmers. Our services include tractor ploughing, training on sustainable agricultural practices, access to quality inputs, linking VSLAs to mainstream financial institutions, lobbying for tailored financial products, facilitating microcredit for women’s groups, promoting access to productive lands for women, and supporting commercial production of various cash crops soya, groundnuts, sorghum, cashew and vegetables. Bee keeping and honey production with demonstration.

Education

We recognize the transformative power of education. While we primarily focus on agricultural and financial literacy, our commitment to education extends to creating awareness, providing training, and encouraging lifelong awareness among community members, encouraging early enrolment of children and promoting action for children stay in school.

Health

Healthy communities are the foundation of sustainable development. We work on creating awareness about health issues, promoting preventive healthcare, and supporting access to healthcare services in underserved areas.

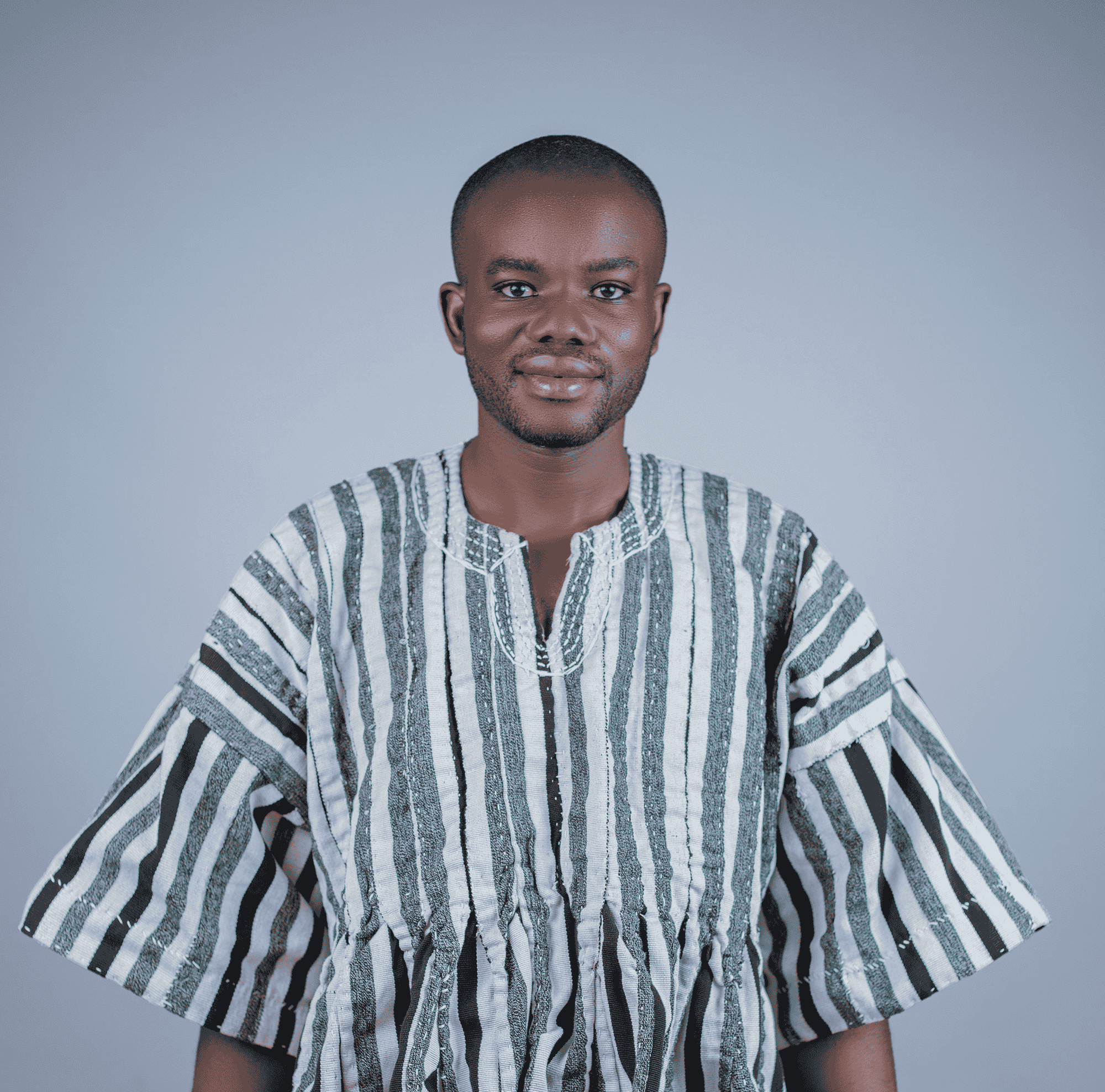

Mr Domba Abdul-Rahaman

Founder and CEO

Mr Domba Dari Yakubu

Board Member

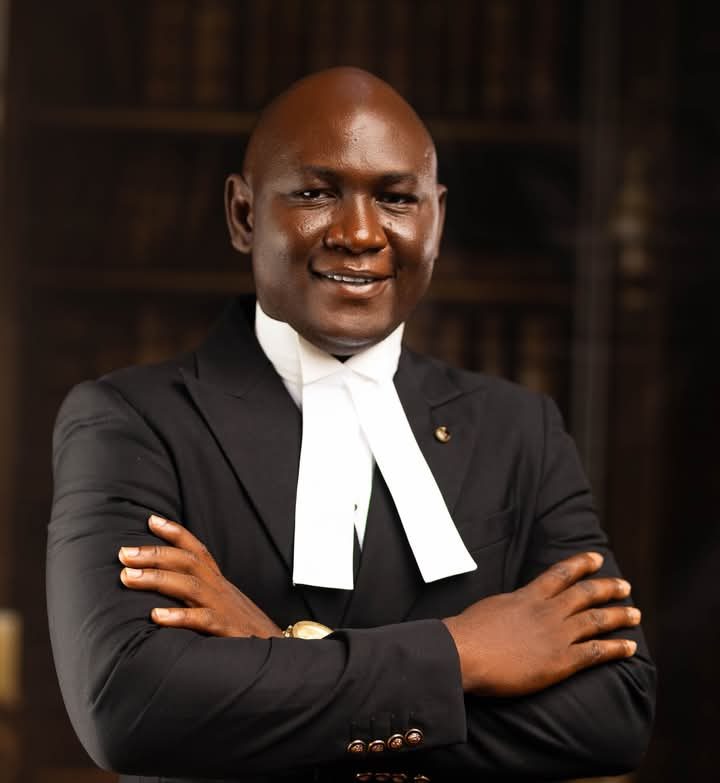

Mohammed Abdul Wahab ESQ.

Executive Secretary and Legal Advisor